Interview with Francisco Belil, President of Feique

Could make us an assessment of the financial year 2003 for the Spanish chemical industry?

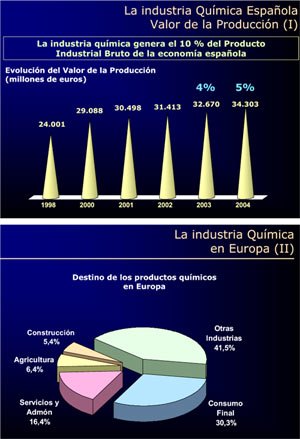

It is certainly a notable increase, especially if we consider both the difficult international situation that has moved the exercise, as that half of the European chemical industry has grown three times less (1.6 percent).

Basically our good behaviour has been based in a significant increase in the domestic chemical demand and good access to foreign markets that we have had, because not in vain today we export almost 50 percent of what we produce.

What is to be the evolution of the sectoral distribution of Spanish chemical industry? Is it true that we are moving towards a greater added value industry?

On the contrary, both the chemistry of health and consumption totalling today respectively 27 and 35 per cent of the whole of the sector, against the quota of 20 per cent that they both had in 1977.

With regard to increasing the competitiveness of the sector what improvements or measures would be taken in the short and medium term, in the opinion of Feique?

Compared to the first of them, it is necessary that in the period 2004-2007 will give priority attention to the development of transport infrastructure, both by road as a rail, maritime or airport, not only from the point of view of investments required, but from the perspective of quality and price. Let us not forget that our port dues exceed those applied in the countries around us, or that the transport by road and rail are burdened by the additional costs which are respectively the excessive number of tolls and the unavailability of the European gauge.

It is also urgent that the Government and the autonomous communities coordinate a specific plan for the development of infrastructure for the treatment of waste, as those that exist are insufficient to absorb the current needs. We are at the tail of Europe in this section, which obliges both bear the cost as the risk involved in the export of waste, and prevents a better development of policies for the protection of the environment.

With regard to energy, I think that the recent and negative experiences in different parts of the world are clearly indicative of the need to enhance investments in generation and distribution both of the grid as a gas, as well as enhance our network for the interconnection with Europe and leave our "status" of energy island. Otherwise, the future release of the energy markets in the European Union will not have to Spain the desired effect and we can not take advantage of the competitive advantage that liberalisation.

With regard to r & d, it is necessary to insist on the urgent need to improve and increase the resources devoted to research, development and innovation, because in a competitive global market in which we find ourselvesthe success of our products will depend largely on the capacity we may have to innovate and research in order to obtain new and better products that differentiate clearly from the competition.

While at the national level, our sector brings together 16 per cent of all expenditures and investments for r & d by Spanish companies, the total amount is still insufficient with regard to the surrounding countriesthat double our investments in this area.

Without a doubt, it is necessary that the momentum of innovation starting first of the companies themselves, but it is also necessary to increase public funding for the company - now 10 per cent of the total-.

In this regard, an effort by the competent authorities is essential to guide the research of technology centres and universities to business demand, so that our basic research is the reflection in applied research, in which our investment and generation of patent numbers are still very far from those that wield the countries of our environment.

Two of the most contentious points which has had to deal with the Federation this past year have been the Reach system and the implementation of the Kyoto Protocol. Optimistic or pessimistic before them? What changes or new decisions can we expect for the coming months?

While it is true that the successive amendments have improved the proposals and initial texts, still the established system remains inefficient, bureaucratic and costly, especially for SMEs, which should cover 80 per cent of its cost.

But not only the own effectiveness of the system is at stake, but it could lead to a process of industrial relocation with serious consequences for the economy and employment. While the European Commission has been required by the Member States to submit a comprehensive study of the impact of REACH on the European economy, it has not been addressed yet, and the EU Executive confined itself to assess the costs of the proceedings.

Both France and Germany Yes there have been studies of impact, and they show a highly worrying figures on the implications of REACH: the annual loss of 1.5 per cent of GDP over the next decade and the reduction of 1.8 per cent of the active population. These data, extrapolated to Spain, would mean a loss of more than 12,000 million euros and the destruction of 280,000 jobs. It is important to note that the chemical industry is supplying of practically all the industrial sectors, so that any impact on our industry has a considerable multiplier effect.

As for the future, there is still room to improve various aspects of the registration, evaluation and authorisation procedures, eliminating bureaucratic burden and unnecessary costs. What is clear is that the regulation should be improved if we want to have an effective system to ensure the protection of health and the environment, and increase the competitiveness of the European chemical industry.

With regard to the Kyoto Protocol, the truth is that the chemical industry generates the order of 3 per cent of the emissions of greenhouse gases, and although as a sector we are not affected by the emissions trading directiveWe can provide solutions based on our products. Something as simple as increasing the use of insulating chemicals in construction would reduce emissions from the use of heating and cooling our homes to a third party. At other focus key, such as transport, we have demonstrated the effectiveness of our products to reduce its environmental impact. In fact, a current car generates 10 per cent of the pollution generated by 50 years, and this has been possible thanks to chemicals such as polymers, allowing for their greater lightness travel more kilometers per unit of fuel consumed, or additives that reduce emissions.

But regardless of the capacity of our sector to provide comprehensive and effective solutions and contribute to the reduction of emissions, our own emissions per unit of production have been reduced significantly.

Since 1990, year basis for the Kyoto Protocol, until 2001, the chemical industry has increased the value of their production over 85 per cent, while our emissions in the same period have only done so by 7 percentless than half of which enables the Protocol to Spain (15 percent).

In any case, the problem of Spain to meet Kyoto is that our growth cannot commit himself. It cannot be that compliance will generate relocation and job losses. The origin of the problem is that every Spanish has the right to emit less CO2 than any other European citizen, unless he is Portuguese. In fact, if the allocation of emissions per capita to Spain would have been the assigned to Germany, United Kingdom, France, etc., already would be meeting the objective.

It is therefore necessary that there should be greater flexibility in the implementation of the Kyoto Protocol, that our country can not give up its growth. It would be unfair that countries that have been issuing much more than Spain historically, now sell us emission rights that involve unacceptable costs.

Safety and health at work are priority objectives of the commitment of progress of the global chemical industry. In the case of Spain, could you tell that we move towards a safer industry? What does Feique here?

Thus, in 2002, investments of the chemical companies adhering to compromise progress amounted to EUR 70 million, 55 per cent more than what is invested in the first year of implementation of the programme.

The results are inconclusive. In ten years we have reduced the accident frequency rate 40 per cent, and our levels of accidents are six times lower than the industrial average Spanish, and lower even than those registered in seemingly more secure as public administration or hospitality sectors

Finally, how it contemplates the future (year 2004) short and medium term, Spanish chemical sector both in our country and abroad?

We also expect a greater acceleration of foreign trade, with increases of 4.5 per cent, and a strong momentum of domestic demand, which will put the consumption of chemicals in Spain well above the 45 billion euros. In general, and in line with the international recovery, a good behavior is expected.

In the middle and even the long term, we will maintain a line of constant growth, whereas the demand for chemical products will continue to increase in almost all of its branches. But we must be extremely attentive to the evolution of REACH prior to encrypt these perspectives, that the new regulation can drastically diminish our competitiveness if substantial changes in the current proposal are not articulated.